LandBridge LLC: Asymmetric Gold in the Permian Dirt

“Buy land, they’re not making more of it.” — Mark Twain

I’m not looking for safe bets. I’m not in the game to clip 8% a year. I’m looking for asymmetric setups: limited downside, massive upside. Ideas where I can concentrate capital and let compounding do the heavy lifting. LandBridge LLC (ticker: LB) is one of those ideas.

Right now, oil is hated. It’s not politically correct, it’s not a talking point at Davos, and it sure isn’t showing up in most ESG-aligned portfolios. But the reality on the ground is brutally simple: we’re not replacing oil anytime soon. Despite trillions spent and political tailwinds, the global energy transition is failing to meet even its softest targets. Volumes don’t lie. We simply don’t have scalable replacements for the amount of oil the world demands.

Which means companies that benefit from long-duration oil production — without taking the risk of drilling — are in a very interesting spot.

That’s where LandBridge comes in.

Royalty Model, Capital-Light, Real Moat

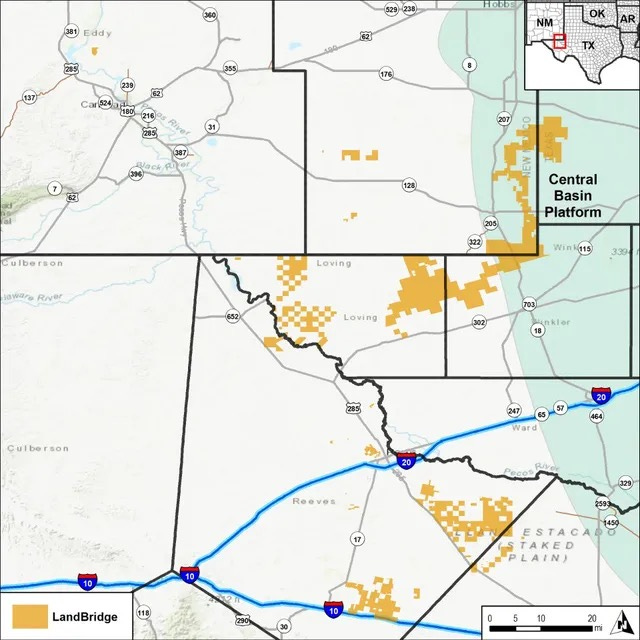

LandBridge owns surface rights to over 273,000 acres in the Permian Basin, the most prolific oil-producing region in the U.S. They lease this land out to drillers and service companies, collect royalties, and avoid the operational risks entirely. It’s a royalty business, similar to what made Texas Pacific Land (TPL) a monster compounder over the last decade.

But here’s the kicker: LandBridge doesn’t stop at royalties.

They also own a high-quality, underappreciated water infrastructure platform called WaterBridge. And if you know anything about drilling in West Texas, you know that water is the bottleneck. You need water to frack, to dispose of wastewater, and now — increasingly — to cool data centers.

Yes, data centers.

LandBridge sits on land that’s not only oil-rich but power-rich. West Texas offers cheap, stable electricity. That makes it a prime region for AI infrastructure buildouts — the kind of hyperscale computing clusters needed for large language models, scientific workloads, and the future of enterprise compute. LandBridge has already announced ambitions to build a 1-gigawatt data center campus, paired with a solar farm and power infrastructure. That’s not a side project — it’s a third leg of the business, and the optionality is enormous.

The Comparison That Matters: TPL vs. LB

Texas Pacific Land has returned 665%+ over the past five years. It’s the benchmark. It’s the proof that this model works.

But here’s the truth: TPL has already had its run. It’s now a $13+ billion company. It’s on institutional radars. It’s too big for most funds to ignore, and too big for some of us to bother with. LandBridge, on the other hand, is sitting at just under $2 billion in market cap, earlier in the curve, with more moving pieces and greater optionality.

TPL is oil + land.

LandBridge is oil + land + water + data centers.

That’s not a small difference. That’s a dramatically more diversified value stack. If TPL could run 7–10x in a decade, what can LandBridge do with three monetizable vectors and inflation-protected assets?

Skin in the Game

One of the biggest green flags: insiders own a massive chunk of the company. David Capobianco, the Chairman, owns more than 100 million shares. Management is locked in. They win if we win. That alignment is something I’ve learned to prioritize more and more over the years. You want operators who think like owners — because they are owners.

And the company is behaving like one with a long-term vision. In late 2024, they acquired an additional 46,000 surface acres for $245 million in the Southern Delaware Basin — a savvy move that expands their royalty and infrastructure footprint at a time when others are pulling back.

This isn’t a roll-up. It’s a compounder in disguise.

The Macro Case: Oil Isn’t Going Anywhere

No one wants to talk about oil right now. And that’s exactly why I’m paying attention.

We’re falling behind on every climate benchmark we’ve set. Electrification is hitting physical bottlenecks. Grid capacity is maxed in several regions. And the uncomfortable truth is that oil is still foundational to global growth — especially in emerging markets.

But this isn’t a bet on oil prices. LandBridge is tied to volumes, not spot prices. They get paid when people produce — not just when the price of WTI spikes. And as long as the Permian keeps pumping, LandBridge keeps collecting.

This is not a cyclical, levered E&P play. This is a real asset compounder with embedded cash flow and optionality on two megatrends: energy security and AI infrastructure.

The Setup I Want

I’m not buying just yet. I want more panic. I want the oil price to flush and sentiment to collapse — because that’s when LandBridge will be on sale. And when it hits my price?

I’m going in hard.

Because this is exactly the kind of company Warren Buffett would’ve bought back when he was managing small money. He actually owned Texas Pacific Land in his partnership days. But LandBridge today is too small to move the needle for him — and that’s what makes it interesting for me.

Why This Fits My Playbook

I run an ultra-concentrated portfolio. I want massive asymmetry, not market exposure. I want misunderstood assets. I want insider alignment. I want inflation hedges, optionality, and secular tailwinds. If I can find all that in one name, I don’t need twenty others.

LandBridge checks every box:

Cash flow and upside

Skin in the game

Hidden AI angle

Energy and water exposure

Strategic location

And the best part? Nobody’s paying attention.

That’s where I make my money. That’s where the next 8x comes from.