Oscar Health: Why I Am More Bullish Than Ever

Over the years, I have learned that truly great investments rarely look comfortable in real time. They usually look controversial, misunderstood, and emotionally difficult to hold. Oscar Health fits that pattern perfectly.

It has been volatile. It has been doubted. It has been written off multiple times. And yet, quietly, systematically, it has built something that very few people in the market fully understand.

With the release of the 4Q and Full-Year 2025 Fact Sheet, the picture is now clearer than ever.

Oscar is no longer a “promising startup.”

It is becoming a scaled, infrastructure-like healthcare platform.

And at today’s valuation, the market is still pricing it like an experiment.

From Startup to System

For years, Oscar was treated as a tech-enabled insurance startup. A nice idea. A good interface. Maybe some clever software. But “real insurers” were supposed to crush it eventually.

That narrative is breaking.

The company now serves 3.4 million members as of February 2026. That is not a niche product anymore. That is a meaningful national footprint.

Membership at this scale changes everything.

It improves risk pooling.

It improves data quality.

It improves pricing power.

It improves operating leverage.

Scale is the most important asset in insurance. Oscar now has it.

At the same time, management is guiding for $18.7 to $19.0 billion in revenue in 2026, up 61 percent year over year. That is not “slowing growth.” That is acceleration at scale.

Most companies grow fast when they are small. Almost none grow this fast at this size.

This is rare.

Market Share Is the Real Story

One number matters more than almost any other in this fact sheet: market share.

Oscar is growing from 17 percent to 30 percent across its footprint.

That is massive.

This tells you three things.

First, customers are choosing Oscar.

Second, incumbents are losing ground.

Third, the product is working.

Insurance is not a fad business. People do not switch lightly. They switch when something is materially better.

This level of share gain is proof of product-market fit in one of the hardest industries in the world.

Efficiency Is Catching Up With Growth

For a long time, critics said: “Yes, Oscar grows, but it will never be profitable.”

That argument is now collapsing.

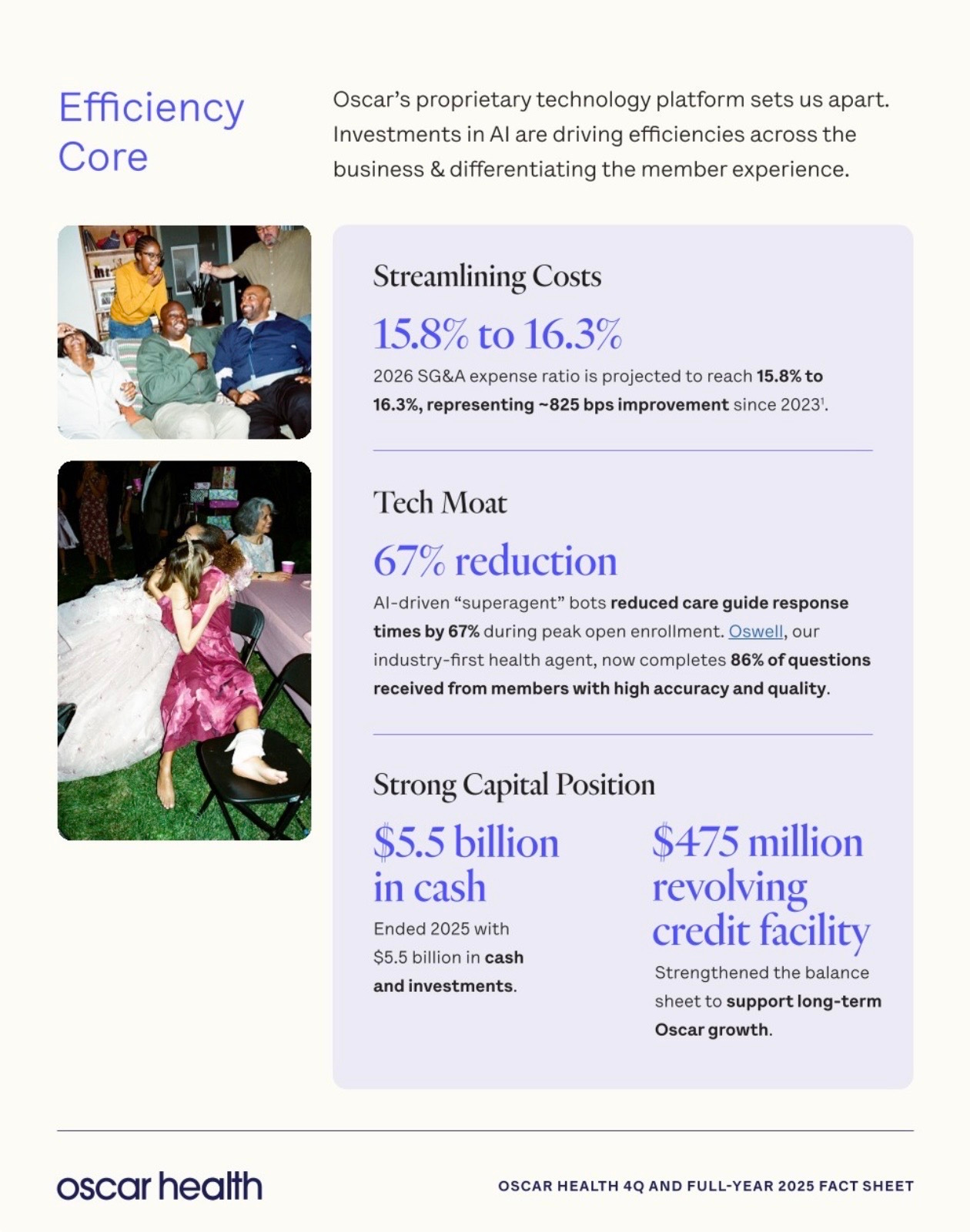

SG&A is projected at 15.8 to 16.3 percent in 2026. That represents an improvement of around 825 basis points since 2023.

This is operating leverage in action.

The platform is scaling.

The fixed cost base is being absorbed.

Marketing is becoming more efficient.

Technology investments are paying off.

This is exactly what you want to see in a company transitioning from growth to compounding.

The Tech Moat Is Becoming Visible

Oscar’s AI-driven “superagent” system reduced care guide response times by 67 percent during peak enrollment. It now completes 86 percent of questions with high accuracy.

This is not marketing fluff.

This is cost reduction.

This is service improvement.

This is retention.

This is margin expansion.

Insurance is an information business. The company that processes information faster and cheaper wins over time.

Oscar is building that advantage quietly.

The Balance Sheet Changes Everything

Now let us talk about the number that matters most.

Oscar ended 2025 with $5.5 billion in cash and investments.

Let that sink in.

Five and a half billion dollars.

At the same time, the market capitalization sits around $3 billion.

You are effectively buying the operating business for less than zero.

This is extreme.

It gives Oscar:

Unlimited runway

Strategic flexibility

Pricing power

Defensive strength

Acquisition optionality

Downside protection

Most growth companies are fragile. Oscar is fortified.

This is not a company that needs capital. This is a company that can deploy capital.

That is a fundamental shift.

Profitability Is No Longer Theoretical

Management expects around $750 million in improvement in earnings from operations in 2026.

This is not “adjusted EBITDA hope.”

This is structural improvement.

With scale, efficiency, and tech leverage, Oscar is approaching sustainable profitability.

When insurance companies cross that line, their valuation frameworks change permanently.

They stop being valued like experiments.

They start being valued like financial infrastructure.

That is when reratings happen.

The ICHRA Opportunity Is Underappreciated

One of Oscar’s most important long-term advantages is its position in the ICHRA market.

ICHRA allows employers to move employees from group plans into the individual market with subsidies.

This is a structural shift in American healthcare.

Oscar is positioned as a leading beneficiary.

Millions of employees are likely to move into this system over time. Oscar is already built for it.

This is not a one-year story. This is a decade-long tailwind.

Why This Is My Largest Position

People sometimes ask why I am so concentrated in Oscar.

The answer is simple.

It combines:

Structural tailwinds

Regulatory moats

Scale advantages

Technology leverage

Balance sheet strength

Asymmetric valuation

Very few companies offer all of this at once.

At current levels, I see limited downside relative to upside.

You have:

A fortress balance sheet

Rapid growth

Rising margins

Growing market share

Clear path to profitability

And you are paying less than cash.

This is not normal.

Why I Keep Adding

Volatility does not scare me. Lack of fundamentals does.

Oscar’s fundamentals are improving across every major dimension.

Members up

Revenue up

Share up

Costs down

Margins improving

Cash massive

This is what compounding setups look like early.

They look boring to traders.

They look risky to tourists.

They look obvious in hindsight.

I am adding because:

The business is de-risking

The valuation is not reflecting it

The narrative is still lagging reality

That is the sweet spot.

The Bigger Picture

Healthcare in the US is broken. Everyone knows it.

Oscar is not trying to patch it. It is rebuilding parts of it around the consumer.

Data-driven pricing

Personalized plans

AI-driven service

Integrated platforms

Direct engagement

This is how modern financial infrastructure is built.

We saw it in payments.

We saw it in banking.

We saw it in trading.

Now we are seeing it in insurance.

Oscar is at the center of that shift.

Final Thoughts

This is not a short-term trade for me.

This is a multi-year compounding bet on:

A category-defining platform

Run by aligned management

With structural advantages

At an irrational valuation

The market still sees Oscar as “risky.”

I see it as becoming durable.

That gap is where returns come from.

That is why it is my largest position by far.

That is why I am still adding.

And that is why I am more bullish than ever.

FJ