ServiceTitan: Building the Operating System for the Trades

Bold Bets on Category-Defining Companies

I have added a new position to my portfolio. The company is ServiceTitan, ticker symbol TTAN. This is not a trade and not a short-term idea. This is an investment based on the same philosophy that guides FJ Research. I am looking for companies with asymmetric upside, the ability to multiply in value over the coming decade, and the durability to compound over time.

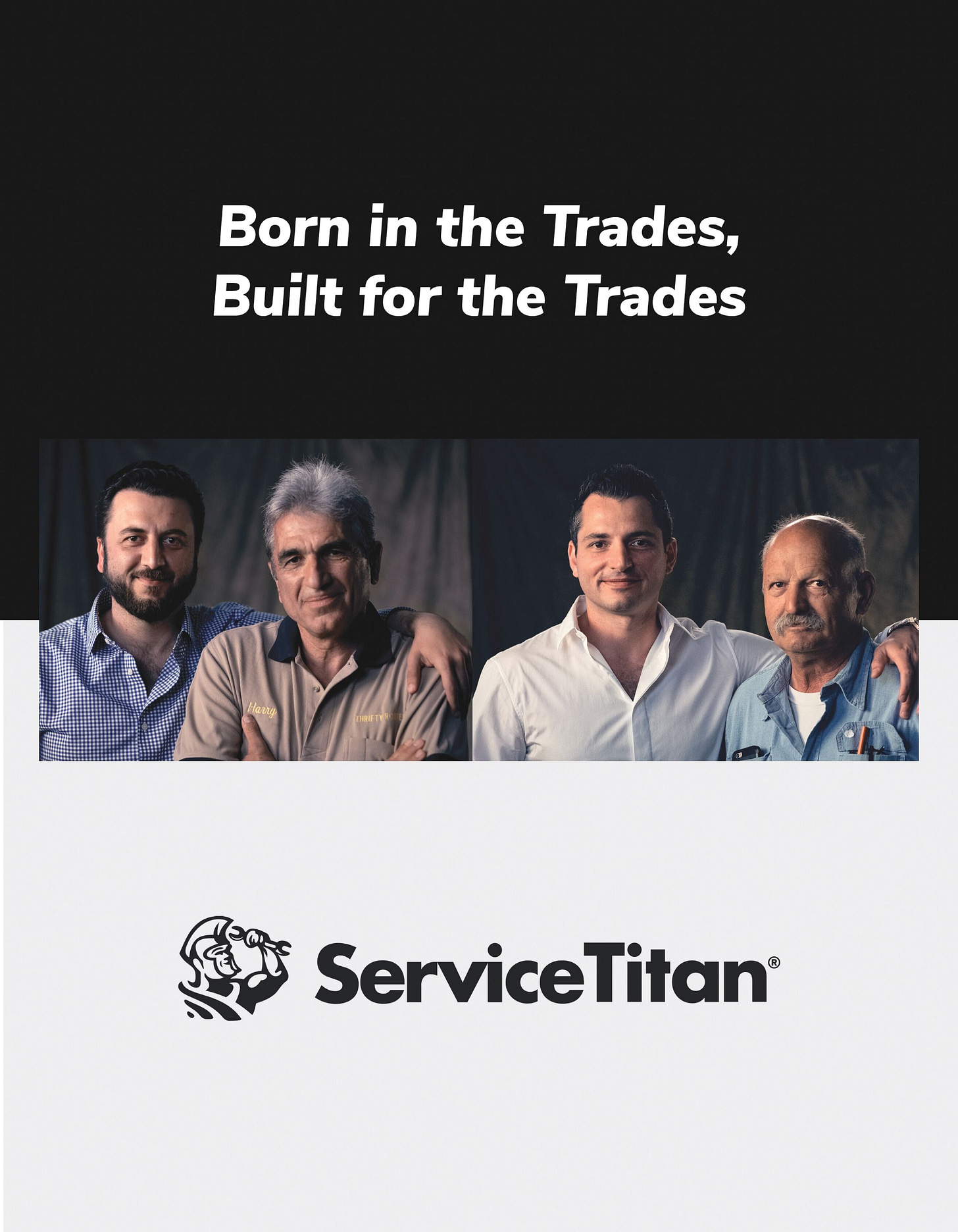

The Founders and Their Story

ServiceTitan was founded by Ara Mahdessian and Vahe Kuzoyan. Both came to the United States as Armenian immigrants and both grew up in families that ran small service businesses. Their fathers were tradesmen. They saw firsthand the frustrations of scheduling jobs with pen and paper, keeping track of invoices by hand, and managing payroll with outdated tools. These were essential businesses in the community, yet they were operating with decades-old processes.

The founding of ServiceTitan was not about chasing a Silicon Valley trend. It was about solving a problem they had lived with since childhood. Their why was clear. They wanted to build the operating system for the trades. They wanted to give contractors the same professional tools that big corporations take for granted. That level of authenticity matters. It creates founder-market fit that cannot be manufactured.

The Beginning of a Platform

ServiceTitan started small. At first the software helped a handful of local contractors. But it worked so well that word spread quickly. Suddenly tradespeople who had never used advanced software before had a system that simplified dispatch, billing, scheduling, and customer communication. What had been a chaotic, fragmented process became manageable.

Over time the company scaled into a true vertical SaaS leader. Today ServiceTitan is the backbone for thousands of service businesses. It has become more than a tool. For many contractors it is the central nervous system of the company. Once adopted, it is almost impossible to imagine operating without it. That stickiness creates retention, recurring revenue, and pricing power.

World-Class Backers

One of the strongest signals of ServiceTitan’s potential has been the quality of its investors. The company has raised capital from Sequoia Capital, one of the most respected venture firms in the world. It is also backed by Iconiq Capital, the family office for some of Silicon Valley’s most successful technology founders and executives. Other investors include Bessemer Venture Partners, Battery Ventures, TPG, and Index Ventures.

These firms are not casual participants. They have chosen ServiceTitan as one of the rare vertical SaaS businesses that can become a category-defining platform. That matters to me as an investor because it confirms that the company has been tested and validated by some of the sharpest minds in technology investing.

From Private to Public

ServiceTitan came public in December 2024. The IPO provided fresh capital for growth and opened the door for investors like me to own the stock. It entered the public markets not as an unproven startup but as a company with years of growth, thousands of customers, and strong fundamentals.

As of early 2025 ServiceTitan had over 90 million shares outstanding, a clean balance sheet, and a healthy cash position. Debt levels were manageable with a small term loan maturing in 2028 and a credit facility available for flexibility. The transition to public markets has been smooth, and the company is now positioned to compound capital with transparency and accountability.

Growth and Economics

The numbers tell a compelling story. Quarterly revenue has already crossed 200 million and continues to grow at over 25 percent year-over-year. Gross transaction volume on the platform is approaching 20 billion annually, showing the scale of economic activity that runs through ServiceTitan’s software.

Subscription revenue continues to expand at the same pace as overall revenue, proving the recurring model is intact. Net dollar retention is above 110 percent, which means existing customers are spending more each year. Customer acquisition costs are paid back in less than two years, a sign of disciplined growth.

Margins are moving in the right direction. In recent quarters the company has posted positive operating margins on a non-GAAP basis, a major improvement from years prior. The long-term target is a 25 percent margin. That is achievable as the company grows into its cost structure and gains operating leverage.

The Market Opportunity

The trades industry represents more than one trillion dollars of economic activity. ServiceTitan estimates its immediate serviceable market at around 13 billion in software spend, with a broader opportunity exceeding 30 billion.

What excites me is not just the size but the stage of adoption. Most contractors are still using spreadsheets, paper, or outdated systems. The penetration of modern software is extremely low. That creates an enormous runway. ServiceTitan has the chance to become the operating system for millions of businesses that are only now starting to digitize.

Even more interesting is the company’s ability to expand revenue per customer. Today ServiceTitan earns roughly one percent of customer revenue. By embedding deeper and offering more modules, that could rise to two percent. Doubling revenue from existing customers without adding new ones is the kind of upside I want in a portfolio company.

A Different Type of Risk Profile

What separates ServiceTitan from my other positions is the absence of regulatory or political barriers. With Oscar Health I must monitor changes in healthcare policy. With Apollo Global Management I watch financial regulations and systemic risks. With Rocket Lab I consider government contracts and space industry oversight.

ServiceTitan is different. No one is debating whether a plumber should use better scheduling software. No regulator is holding back an HVAC company from using ServiceTitan to manage payroll more efficiently. This is pure growth. The only question is execution.

Looking Ten Years Ahead

If the company continues to execute, the upside is clear. From less than one billion in revenue today, ServiceTitan could compound at high double-digit rates for years. With a massive total addressable market, improving margins, and strong customer retention, a 100 billion market capitalization within a decade is not unrealistic.

At current levels the stock is fairly to attractively valued. This is not one of those software companies priced for perfection. The market has given us an opportunity to buy into a category leader at a reasonable entry point.

Final Thoughts

Adding ServiceTitan to my portfolio is a bet on immigrant founders with authenticity and vision. It is a bet on the trades, on small businesses, and on the power of software to transform industries that have been overlooked for too long.

ServiceTitan is not just another SaaS company. It is building the operating system for the trades. It is a category-defining platform with the potential to dominate a market that is enormous, underserved, and ripe for disruption.

At FJ Research I only add positions when I see true asymmetry. ServiceTitan is one of those rare cases. The downside is limited. The upside is massive. Over the next decade I believe this company has the potential to scale into one of the most important software businesses in the world and to reward patient investors who understand the size of the opportunity.

Great write-up. ServiceTitan feels like one of those underappreciated vertical SaaS platforms with a massive TAM and sticky product. Your long-term framing really resonates.

Keep up the good work!

this is impressive, makes running a trades business so much smoother and skips all the manual admin hassle.