Texas Pacific Land: The Most Durable Business on Earth

There are few assets in the world you can own today that will still quietly compound for your grandchildren 100 years from now. Texas Pacific Land is one of them.

It’s not flashy. It’s not complex. And that’s exactly the point.

This is a story about land. Scarce, productive, essential land. The kind of land they’re not making any more of. The kind of land that sits atop the richest oil basin in North America. A business built for those who think in decades, not quarters.

Let’s unpack why Texas Pacific Land deserves a spot in the rarest corner of an ultra-concentrated portfolio and why I’m watching the price closely as it creeps toward a buy zone under $1,000 per share.

The Permian Basin: The Crown Jewel of U.S. Oil

Before we get to Texas Pacific Land itself, we need to talk about the Permian Basin.

The Permian isn’t just another shale play. It’s the heart of American energy. The most productive oil region in the United States and one of the most prolific in the world. Covering parts of West Texas and southeastern New Mexico, the Permian Basin has become synonymous with shale dominance. If you care about energy security, economic resilience, and industrial power, you care about the Permian.

The geology is world-class. It’s stacked with multiple layers of oil-rich rock, allowing producers to extract more from a single footprint. It’s infrastructure-rich. Pipelines, refineries, and roads are already in place. And it’s enduring. The U.S. Geological Survey keeps upgrading the resource estimate. This isn’t a short-cycle boom. It’s the long game.

Texas Pacific Land owns the land, not the oil companies. They lease the mineral rights and take a royalty. They don’t drill. They don’t operate wells. They simply get paid every time oil flows.

This is capitalism in its purest form. Own the land. Lease it. Collect a check. Repeat.

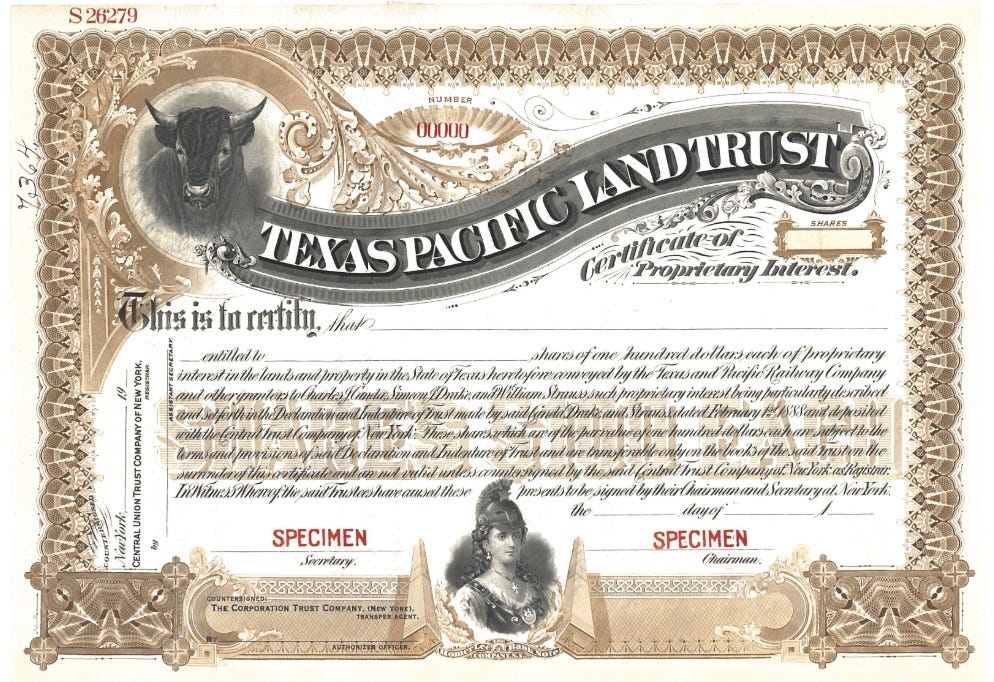

The Founding Story: Born Out of Bankruptcy

Texas Pacific Land has one of the most unusual and unintentionally brilliant origin stories in American business history.

The company began in 1888 as the Texas and Pacific Railway Land Trust. It was created during the bankruptcy of the Texas and Pacific Railway Company. The court had to liquidate assets and pay back bondholders. So, it took the massive land holdings the railroad had acquired, over 3 million acres in West Texas, and spun them into a trust. The bondholders became the beneficiaries.

Nobody knew back then that this barren, remote desert land would become the center of America’s energy revolution.

For most of the 20th century, the Trust just sat there. Quietly owning land. Collecting grazing fees. Leasing parcels. Slowly selling off unproductive acreage. Occasionally picking up oil and gas royalties.

And then fracking happened.

Suddenly, West Texas became ground zero for a shale boom. And Texas Pacific Land Trust, now a leaner entity with a concentrated royalty portfolio, became one of the biggest winners in modern energy investing.

From Passive Trust to Active Corporation

For decades, Texas Pacific Land operated as a passive trust. No aggressive growth, no big ambitions. Just lease the land and cash the checks.

That changed in 2021.

After a series of shareholder disputes and governance concerns, the Trust converted into a Delaware C-Corporation. Texas Pacific Land Corporation was born. While some investors feared this shift might dilute the company’s quiet strength, it actually helped unlock a new era of optionality.

Now the company could actively develop its land. It could pursue partnerships. Expand its water business. Modernize operations. And finally begin to shape its future, rather than passively benefiting from it.

Let me be clear: I don’t want Texas Pacific Land to become a hyper-growth conglomerate. But the transition to a corporation gives it just enough flexibility to stay relevant, manage risk, and reinvest wisely, without compromising the core thesis.

The Land: 868,000 Acres of Strategic Power

Texas Pacific Land owns roughly 868,000 surface acres and 450,000 royalty acres, all in the heart of the Permian.

This isn’t scattered scrubland. It’s some of the most productive, high-traffic oil land in America. Operators like Chevron, Occidental, and Pioneer Natural Resources drill on it. And they pay handsomely to do so.

Here’s the key point: Texas Pacific doesn’t just own the mineral rights. It owns the surface rights too. That opens the door to something far more strategic than most landowners can imagine, the water business.

The Water Business: Quietly Scaling an Essential Utility

Drilling for oil in the Permian requires an immense amount of water, millions of gallons per well. And that water has to be sourced, transported, recycled, and disposed of properly.

Enter Texas Pacific Water Resources.

Launched in 2017, this business segment provides full-service water solutions to Permian drillers. They own the infrastructure. They pump, treat, and distribute the water. They’re turning a natural constraint into a competitive edge.

Water revenue now makes up a meaningful portion of TPL’s earnings. It’s growing. It’s recurring. And best of all, it compounds naturally alongside Permian drilling activity.

This is where the company quietly shifted from a passive trust into a real operating business. But it did so in a way that stays true to the long-term nature of the model. The water business doesn’t require heavy capital risk. It benefits from existing land ownership. And it deepens the moat.

🔒 If you’re not just reading for entertainment but actually building long-term wealth, this is the part that matters. Become a member of our community to see the price I am targeting, why I believe TPL belongs in a generational portfolio, and how this quiet land company has outperformed almost every tech name investors obsess over.